Emergency Fund

What are Emergency Funds?

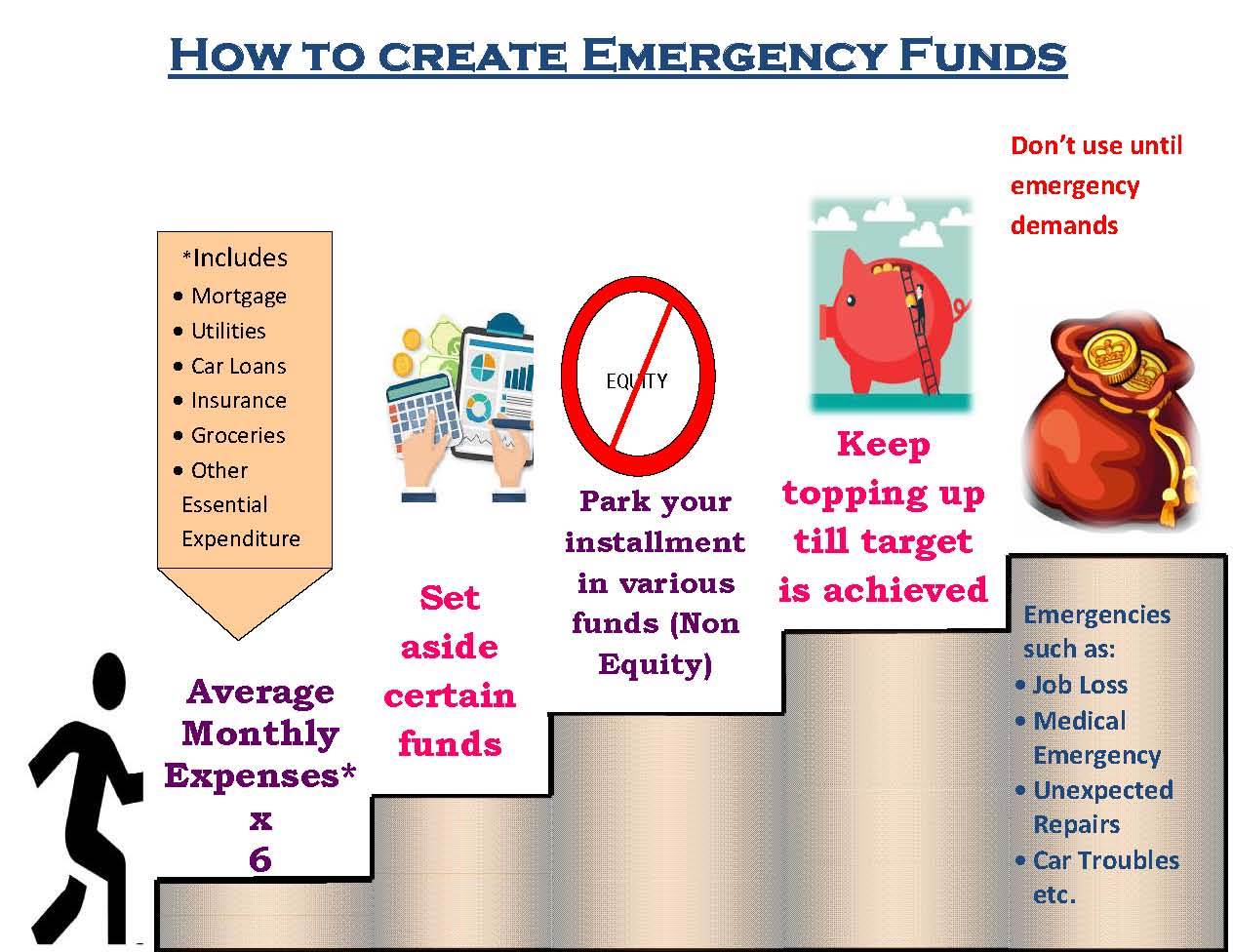

Emergency funds are the amount set aside to meet the expenses during emergencies such as job loss, medical or dental emergency, unexpected home repairs, car troubles etc.

They are designed to cover a financial shortfall when an unexpected expense crops up.

What should your Emergency Fund Cover?

Emergency Fund should carry minimum 6 months expenses including mortgage utilities, car loans, insurance, groceries and other essential expenditure.

Income should not be base to create the corpus for an emergency fund.

What are benefits of having Emergency Fund?

- Helps to keep the stress level down

- Keep a control on your spending.

- Keeps you from making the bad financial decision

- Low Risk/No Risk

- Liquidity

- Accessibility

Where to park Emergency Funds?

- Debt Funds

- Liquid Funds

- Fixed Deposits