Why do we need a Financial Consultant?

Just like a greater cricketer needs a private coach to win a match

Similarly, a person needs a Financial Planner to achieve his / her financial goals as desired.

For Eg:

Mr. Raj and Mr. Rahul ,two brothers were discussing about options for how to save tax and how to save money for their child’s education and their retirement.Their friend suggested them to visit a Financial Consultant to get better investment options. Both the friends started searching for a Financial Planner in Thane,Navi Mumbai and Mumbai region so that they can get better investment options/ideas. Their Financial Planner helped them to aline their investments,helped them set proper financial goals depending upon their needs and requirements and even suggested them to open an Online Demat Accounts for quick and easy investing and also recommended them to invest a particular amount every month in equity mutual funds through Systematic Investment Plan.

Money is the complicated subject there are many things you need to think about to protect it & make most of it

Technology has been a boom to financial services.

Even though people having been using online banking and various online applications for long time still the concept of Online financial planning is new.

You can avail the benefit of Online Financial Planning & get advice for your investments and help you to achieve your financial planning goals.

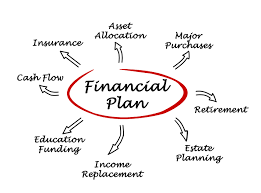

Here are the reasons why the Financial Planners/Financial Consultants are important who can assist you in achieving your financial goal.

Understanding Performance

A Financial Planner helps you understand the performance of fund i.e. how volatile or consistent the fund is and suggest funds which are most suitable to achieve your financial goal

Financial Planner clears the Fog

Financial Planner clears all your doubts regarding investment like:

Where to Invest

When to Invest

How long and how much to invest

Monitoring & Evaluation

Keeps track on performance of the fund asset allocation & takes timely action as and when required by rebalancing

Keeps record and maintenance

Financial Planner helps you keep record of

- Amount invested

- Taxation & Capital Gain

- Helps your family with important financial information and records

- Updating of nominee details & other important records

Financial Understanding

Financial Planner enables you to have a whole new approach to your budget and improving control over your financial lifestyle

Complete 360-degree view

Financial planning is not just about investing money in stocks or Mutual Fund. But financial planner helps you prepare for emergencies or other life events & keeps track on where you spend your money on.

Being Prepared

Financial Planner by taking responsibility for your financial well being, put your money to work for you & make you feel confident & secure about where you are financially lacking.

What is your reason to see a financial adviser?